After You Submit Your Application, Our Voices, Paying For College |

For low-income students, choosing the right college or university is often decided by how much money they will give us. We do not have the luxury of choosing a university in a favorable location or by enrollment size. Some of us can’t even choose the one that offers the best program for our major because it doesn’t grant us enough funding. We, low-income students, are faced with limitations when it comes to going to college.

And yes, scholarships are available, and their abundance does inspire us to apply to as many as possible. However, their competitive nature means not all students will receive a scholarship and therefore we cannot rely just on them. In other words, we need our government to keep funding education access for low-income students. Opportunities that come with programs like the Pell Grant.

What is the Pell Grant exactly?

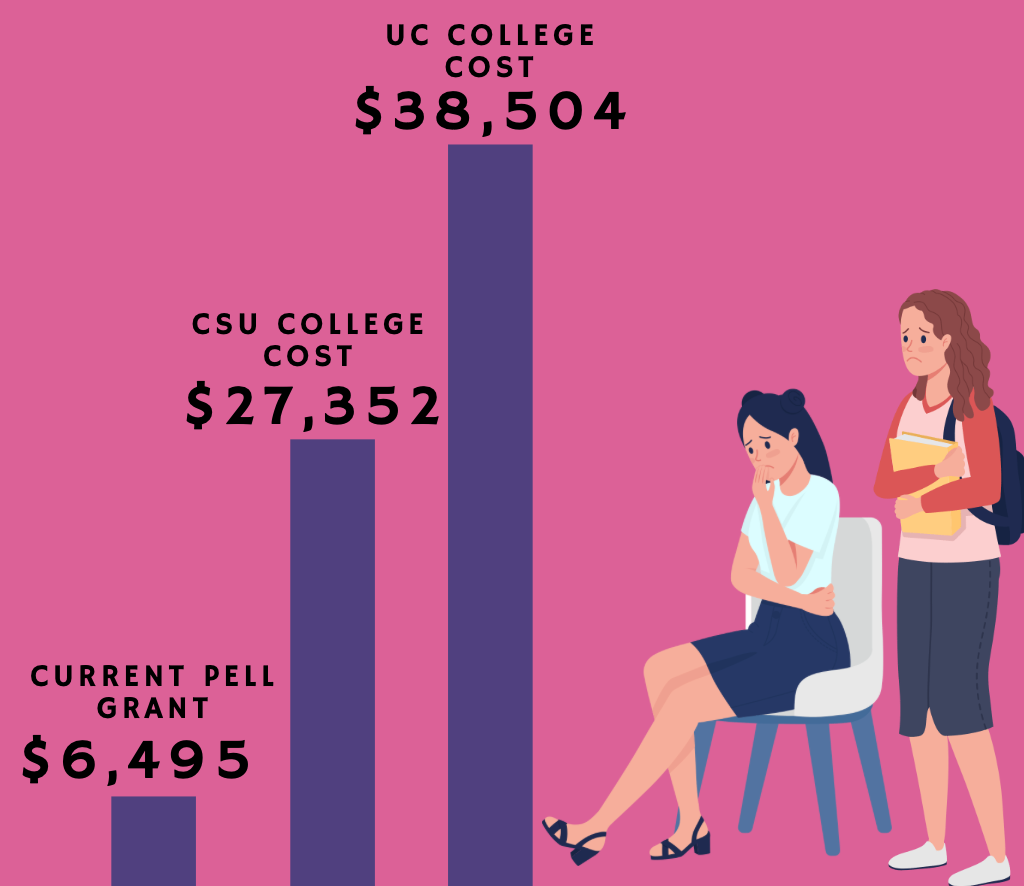

The Pell Grant is a need-based grant awarded to undergraduate students who have not obtained a degree and demonstrate exceptional financial need. It has provided support for about 7 million students each year across 5,000 institutions in the U.S. However, its purchasing power has declined significantly over time. According to the Institute for College Access and Success, the Pell Grant only covers 30% of a college education when it covered about 80% in 1980.

As a Oaxacan low-income student raised in South Central LA and a personal recipient of the Pell Grant, I can vouch that receiving this aid was a significant help for covering my tuition at UC Berkeley during my first two years of college. I felt supported by this assistance and received an additional refund to cover my basic needs like food and housing. However, after my sophomore year, I noticed that my Pell Grant amount was declining as I reached senior year.

This is why we need to build awareness to #DoublePell because it can close the affordability gap for low-income students, leading to higher enrollment and an increase in retention rates. Education Policy Advisor Shelbe Klebs argues that the COVID-19 pandemic has made many students “rethink their post-secondary plans for fall; some may forgo college temporarily or permanently to work to support their families while others may choose to attend a more affordable community college close to home instead of a pricier four-year school farther away.”

Doubling the Pell Grant is the most effective way to make college affordable and available for all students. It can lead to more enrollment of low-income students of color, increase graduate school enrollments with more students pursuing higher education, decrease dropout rates, and restore its purchasing power.

Having this grant available made my college selection process easier because I could choose a good school with the financial aid package that was right for me. I am #ThankfulForPell because I was able to graduate from a 4-year university. By doubling the Pell Grant, I believe more students like me can have greater access to higher education, reach their potential and empower their communities.

Our Voices |

By Changemakers Student Advocacy Fellow Veronica Liu

College: University of California, San Diego

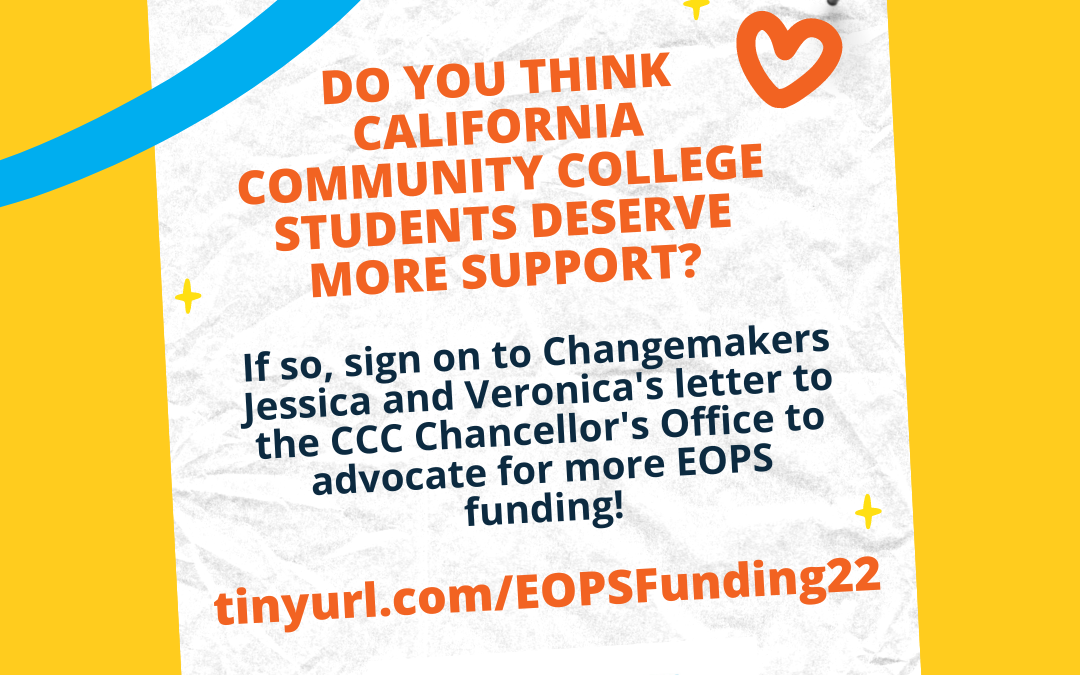

For California Community College students, community college is a time to explore passions and potentially save money compared to immediately attending a 4-year university. For those hoping to transfer into 4-year colleges, the challenges of paying application fees, writing essays, and applying without support can be daunting as they navigate the application process. But, for the nearly 69,000 California community college students enrolled in Extended Opportunity Programs and Services (EOPS), matriculating at a community college and applying to 4-years is not a challenge they must face alone.

Extended Opportunity Programs and Services (EOPS) is a state-funded opportunity program at California Community Colleges aimed at supporting low-income and educationally-disadvantaged students to enroll in and graduate from community colleges and transfer into 4-year institutions. Established in 1969, the California Education Code states that EOPS “encourage[s] local community colleges to establish and implement programs directed to identifying those students affected by language, social, and economic handicaps, to increase the number of eligible EOPS students served, and to assist those students to achieve their educational objectives and goals, including, but not necessarily limited to, obtaining job skills, occupational certificates, or associate degrees, and transferring to four-year institutions.” EOPS was designed with disadvantaged students’ successes in mind.

My fellow Changemakers student advocate, Jessica Hernandez-Beltran, expands on her experience as a community college student in EOPS. She credits EOPS for her successful transfer path, thanks to the program’s financial assistance for textbooks and support with transfer applications.

Through providing resources like textbook reimbursements/free textbooks, advising, and more, EOPS has provided students with the support and guidance needed to excel in community college, empowering students to transfer. Although EOPS students are more likely to complete transfer-level Math and English, earn higher GPAs, stay in school, and earn college credentials, EOPS only supports around 3.71% of the total community college student population–a discrepancy that does not mirror the demographics and eligibility of community college students state-wide. Think about it: how many people do you know qualify for EOPS? Who identifies as low-income, underrepresented, California resident, with Pell Grant eligibility? California is the top state in the U.S. for the most Pell Grant recipients–938,931 college students in CA qualify for the Pell Grant, including around 420,000 students across the 116 CCC campuses, a drastic contrast to the nearly 69,000 students enrolled in EOPS in Community College. Think how many folks you may know that qualify–only around 3-4% of them may be in EOPS, while others are shut out due to insufficient funding.

Funding has always been key in allowing more students to enroll in EOPS and set themselves up for success in college. In 2015, Assembly Bill 490, which increased funding for EOPS, stated that “inadequate state funding in recent years has caused many EOPS and CARE programs to reduce the amount of financial aid, textbook support, and child care grants provided to eligible students in need, to prematurely close the application deadline for acceptance to the program, to deny program services to eligible EOPS and CARE students, or to do a combination of these.” Seven years later, it seems that much still has to be improved upon, especially in regard to funding.

If you would like to show your support, please sign our letter (Deadline to sign on: November 30, 2022) and learn more about our advocacy through the link below:

Sign on here!: https://tinyurl.com/EOPSFunding22

Our Voices |

Let’s Go Basic Needs Fellow: Yvette Hernandez

College: University of California Berkeley

College students today are in a daily battle with the high costs of pursuing higher education, causing many to face food and housing insecurity. From 1985 to 2017, the cost of attending a four-year college or university in the United States rose 497%, more than twice the rate of inflation. During the same time, investments in federal and state financial aid have remained relatively stagnant. This imbalance has resulted in thousands of low-income students struggling to make ends meet at all public university systems in California.

For instance, the California Community Colleges Chancellor’s Office survey showed that 50% of their students faced food insecurity. The University of California Regents Basic Needs Committee found that 44% of UC undergraduates were food insecure. Within the California State University system, a 2018 Basic Needs study found that 41.6% of students experienced food insecurity.

Many low-income students eligible for the Pell Grant have relied on free-or-reduced meals during their K-12 education, and suddenly when they enter college they no longer have a similar option. It is cruel to expect that the most vulnerable students will no longer need food assistance simply because they graduated from high school, especially since many guardians relinquish support at this point.

Legislation has recently passed to support students dealing with food insecurity. The Consolidated Appropriations Act of 2021 and AB 396 have expanded eligibility for students to receive Supplemental Nutrition Assistance Program benefits up to $246 per month; however, this is not enough, considering food insecurity is not the only issue students are facing.

In addition to food insecurity, students are struggling to afford safe housing. Around 60% of California Community College Students and 16% of UC students have reported experiencing housing insecurity. At the CSU 10.9% of students were homeless, and there was no measurable data on housing insecure students. These numbers encompass students that live in their cars, couch surf, and students that do not have a reliable and safe space to sleep.

The major contributing factors to housing insecurity are the limited number of beds available for students to live on-campus, and the high cost of living for low-income students. The UC system currently has more than 280,000 students enrolled and only 100,000 beds. Even though some students prefer to live off-campus or with their families, there is still a prevalent need for additional affordable housing across all public institutions, specifically for low-income students.

Policy makers have passed legislation on improving the availability of affordable student housing, such as SB-169, and the Post Secondary Education Trailer Bill that provides 500 million dollars for the construction of affordable student housing over the course of three years. The funds will be distributed as follows: 50% to the California Community Colleges, 30% for the California State University, and 20% for the University of California.

This is an improvement but it does not guarantee that all low-income students will be able to secure affordable housing. Universities and policy makers should heavily consider prioritizing low-income and first-generation students for housing because securing off-campus housing is difficult without the proper support. Many landlords require excessive and unrealistic lease requirements like having an income three times the rent amount or more, a good credit score, and application fees. Some landlords offer cosigner options, but for low-income students their families may also not meet these housing requirements, making them virtually ineligible for off-campus housing.

The costs of pursuing a higher education is incredibly high for many students to afford today. Which is why there are 1 million fewer students in college as found by the National Public Radio Organization on Education. Many people stereotype college students as lazy for not being able to afford their basic needs but it is simply not the case. The U.S Department of Education found that in community colleges 72% of full-time college students were working either part-time or full-time jobs on top of their full course load. In four-year universities 41% of students were also working.

Students are already working to support themselves and are still unable to afford their food, housing, and college expenses. This highlights the insufficiency of financial aid. Millions of low-income students receive the Pell Grant, however, it has lost its value because it has not kept up with increasing college costs. Fifty years ago, this same Pell Grant covered three-quarters of the cost of attending a 4-year public college, today it only covers one-third of the cost of college with inflation taken into account.

Congress should double the Pell Grant to cover the costs for Community College students and 59% of the educational expenses for students at four-year public colleges. Without further action, higher education will continue being unaffordable to low-income students, and food and housing insecurity will continue to rise.

We have to stop normalizing food and housing insecurity as a necessary evil for obtaining a degree. As students, we are pursuing higher education to better ourselves, our futures and our communities. If we do not act soon we will continue to sacrifice the mental and physical health of low-income students, which makes it much harder to pursue and complete higher education.

Join the movement to double the Pell Grant.

For resources and ways of getting involved, visit doublepell.org and letsgotocollegeca.org.

Our Voices |

By Let’s Go Basic Needs Fellow: Julianne Jamir

College: University of California San Diego

Housing insecurity and homelessness amongst college students are more prevalent than ever. According to the 2019 #RealCollege annual survey conducted by The Hope Center for California Community Colleges, 60% of community college students experience housing insecurity and 19% experience homelessness. At the University of California 16% of students experience housing insecurity and 5% experience homelessness. In the case of Cal State University students, the 2018 CSU Basic Needs Study found that 10.9% of students experience homelessness. This is an absurd amount; however, since housing insecurity and homelessness can manifest in many ways, it is possible that a percentage of college students did not participate in these studies because they were unaware that they experienced housing insecurity.

Most California colleges only guarantee on-campus housing for the first two years, which means that all students have to seek off-campus housing at some point. Some students start even earlier because on-campus housing is unaffordable, especially for low-income students and undocumented students. That being said, the most common causes of housing insecurity and homelessness amongst college students are the impractical requirements that landlords demand and the affordability of rent.

First, the majority of off-campus housing apartments require renters to have a credit score of at least 650 or higher but in order to be approved for a credit card, a reliable source of income plays a huge role. This requirement is impractical considering that most students would have just started working and building their credit scores at this time. Additionally, landlords require proof of income that is double and sometimes even triple the amount of rent. College students tend to work part-time, minimum-wage jobs because of their hectic schedules or lack of experience.

These requirements present unnecessary challenges that set up students to fail in securing stable housing throughout their time in college. The second reason why housing insecurity and homelessness is prevalent amongst college students is the affordability of rent. This is dependent on location but because of rising living costs and prices in California, most colleges are considered unaffordable.

For example, the University of California San Diego is located in La Jolla, which is one of the most expensive neighborhoods in San Diego. To offer a better picture, a single bedroom apartment in La Jolla usually ranges from $2000-$3000, not including utilities and other bills students would have to pay monthly, which average around $100 depending on usage.

This forces students to choose between staying with their families, where they may be unable to focus on their studies (true with most low-income first generation students) or living with multiple roommates, of which some might reside in the living room. These options are used to alleviate the burden of monthly expenses; however, they are not always sustainable. These barriers prove how difficult it is for students to get safe and secure housing.

Overall, I believe that we as a community and the people in power need to do a better job with resolving these issues. No one should ever have to experience being housing insecure and/or homeless. All public institutions in California should increase affordable and guaranteed housing for students, especially for low-income and undocumented students.

By doing so, it would not just help college students to get stable housing, it would also help when it comes to decreasing students’ list of worries so that they have more time to focus on getting their degree. Students would not have to worry so much about how they would pay rent and would actually have extra money for other basic necessities, such as food. As we know, food insecurity is highly likely to occur simultaneously with housing insecurity and homelesness. This prevents students from being in a position where they would have to choose whether to prioritize food over rent or vice versa.

Our Voices |

By Let’s Go Basic Needs Fellow: Krystal Mae Raynes

College: Cal State University Bakersfield

In many parts of Bakersfield, we see homeless people push shopping carts and hold cardboard signs on street medians. Sometimes, we assume that these people have made bad decisions in their life and that their living situation is their fault. This image and assumption are what many people think of when talking about the topic of homelessness. However, homelessness has many faces; and today, many of them are college students, like me.

College homelessness looks different from the textbook example we usually think of. College students usually experience homelessness when they find themselves sleeping in their cars or “couch surfing” – borrowing friends’ or families’ extra futons or couches for a week or two and then having to find another place to stay at. Both these situations fall under the U.S. Department of Education’s definition of homelessness, which includes “youth who lack a fixed, regular, and adequate nighttime residence”. Dr. Jason Watkins, Assistant Director of Basic Needs for California State University, Bakersfield (CSUB), describes student homelessness as “not making bad choices,” but as “a set of bad circumstances.”

Many college students in Bakersfield are first-generation or low-income – 65% CSUB students and 55% of Bakersfield College undergraduate students are on Pell Grant, a federal grant awarded to students who display exceptional financial need. According to a survey conducted by CSUB’s division of Student Affairs during the winter of 2020, about 7% of students – or approximately 770 students – faced homelessness. I am one of those students. As a CSUB student who has couch-surfed more than a few times during her college career, Dr. Watkin’s statements ring true with me. My first run-in with homelessness began because of an abusive household situation, and it took a few tries to get permanent housing. In the summer of 2020, I had to utilize CSUB’s emergency housing program for a month to get back on my feet. That time was absolutely critical to get me connected to the on-campus food pantry, mental health services, and fixed housing. Without it, I most likely would have had to drop out of school and delay my degree. In Dr. Watkins’ experience, the causes of homelessness in students are usually caused by instability in the home due to abuse or sudden changes to roommates’ contributions to rent. Dr. Watkins recalled an instance where a student had to utilize CSUB’s emergency housing because all of his roommates decided to move back home during the COVID-19 pandemic, leaving him without a means to pay a full bill of rent.

Although CSUB provides emergency housing and a meal plan for up to 30 days in their dormitories, students with families or pets fall through the cracks. In the short term, CSUB is looking to expand its hotel voucher program for students that wouldn’t be able to stay in the residence halls. The most important solution is within the community. Bakersfield residents can donate to CSUB’s emergency fund but most importantly, they can choose to support more affordable housing for college students.

If students drop out due to homelessness, we lose on shared prosperity for our region. An economic impact report generated by the California State University system cited that in 2019, San Joaquin Valley CSU alumni generated $521 million in state and local tax revenue. When homelessness affects our students due to circumstances out of their control, it becomes our community’s loss. We need to understand the value of investing in affordable housing for our students, the majority of whom stay in Bakersfield and contribute to our growing economy.

Our Voices |

By Nathen Ortiz

As a first-generation college student, I experienced many emotions as I prepared for my first year of college. I was excited to be on a beautiful campus like Cal State Fullerton and meet so many new people but I was also very nervous and often stressed about the responsibilities that awaited me. As I learned more about the resources available on campus, I was relieved to learn about on-campus mental health services. I always wanted to seek assistance with my mental health, and I was grateful my university offered therapy sessions. Seeking help was something new to me, as I have often neglected my mental health. Yet, I was excited about this new opportunity to challenge myself and step out of my comfort zone.

The first time I decided to schedule an appointment to meet with an on-campus therapist was very frustrating. I called Counseling and Psychological Services to schedule an appointment and was on hold for almost an hour. Finally, I got through and I was told I was not able to make an appointment because I called in the afternoon. The next day I called again, this time in the morning, and I was once again on hold for a while. This time I was told the next available appointment was three weeks away. After hearing this I decided to give up on setting up an appointment to meet with an on-campus therapist.

During the pandemic my university offered virtual services for each of their departments, this included Counseling and Psychological Services. Like many others, the pandemic impacted my mental health, and I took this opportunity to seek help from a therapist. Although the services were virtual, I once again had to wait three weeks for the next available appointment. Finally, on the day of my appointment, I met on Zoom with a therapist. However, I struggled to communicate with them because I did not feel comfortable due to the lack of representation and connection. I did not schedule a second appointment.

Following my experience with on-campus mental health services, I understand the frustration many other students have experienced on their campus. As a student advocacy intern here at Let’s Go to College CA, I wanted to encourage students to advocate for themselves to improve on-campus mental health services. Therefore, our team decided to conduct a survey to gather feedback from college students across California and learn about their experience with on-campus mental health services. Through the survey, we found that students wish for campuses to hire more diverse staff to reflect the diverse student population, improve the ratio of mental health professionals per student, decrease the wait time students have to wait for an appointment, and allow students to have more free therapy sessions. We will continue to analyze survey results and create opportunities for students to advocate for improved mental health services on college campuses.

Our Voices |

By Dixie Samaniego

There are many college affordability challenges that must be addressed for our students today. If I were a

college president, I would tackle costs beyond tuition specifically transportation to better support

students. Whether students are driving or using a rideshare service, we all struggle and spend much more

than we need to. Colleges must address transportation costs for students and introduce creative ways to

lower costs such as allowing parking permits to be shared.

As a first-generation college student attending Cal State Fullerton (CSUF), I experienced unknown

transportation costs of commuting to campus during my first year amounting to over $800. When I look

back on this experience, I recall all the times I struggled and worried over getting to class and hoping my

car would start. My car had small, but costly maintenance issues throughout the semester. Yet, I never

thought that I would have to miss a final exam because of them. I remember feeling like I was in some

soap opera as I sat in my car missing my English 100 final exam. I never knew that my academic success

in college was contingent upon having enough money to even get to campus. I know as a student at a

commuter school so many other students have the same worries and the same struggles.

This year due to COVID-19 I’ve been able to save money by not having to commute and pay for parking

permits, gas, and unexpected car issues. The lingering question I ask myself and the question every

commuter student is asking–what happens when we transfer back to in-person instruction? In Fall 2019

the parking permit was $285 and now, in Fall 2020, it is $334 due to a new parking structure. According

to the California Aid Student Commission’s (CSAC) Student Expenses and Resources Survey (SEARS),

a third of students reported housing insecurity in the past month and 35% reported food insecurity or

hunger. When students are forced to pay for permits they weigh whether to eat a healthy meal, eat at all,

or have stable housing. A breakdown of CSAC’s survey also reports that Black students that receive Cal

Grant and Pell Grant report the biggest food and housing insecurity–54% and 47% respectively. If

students had the option to share parking permits they would be able to use the money they save to eat

meals and/or have stable housing while pursuing their degree.

With no clear forecast of whether or not parking permits will decrease in price, allowing students to share

permits will alleviate the financial burden for current and future Titans. Many students are only on

campus a couple of days a week. Even during days students are on campus, many only stay for a couple

of hours and then head to their job. While it isn’t an issue for some students now that they’re at home, the

uncertainty is still there for students having in-person instruction. Allowing students to share parking

permits would reduce the indirect cost of college for almost half the student body at CSUF.

Continuing my education is important to me as a first-generation college student. Allowing students to

share parking permits and split the costs of expensive permits would relieve a financial burden for so

many. This is especially the case in the COVID-19 era and the financial insecurity students across the

nation are facing. Continuing to operate like we did before COVID-19 will not only make it more difficult

for current and future students to succeed but further increase inequities that have already existed in

higher education. Students have enrolled in CSU’s and overall higher education institutions nationally in

record-breaking numbers, in spite of a global pandemic. As we recover from this pandemic, it is

imperative for our higher education leaders and institutions to ensure every student is able to afford costs

beyond tuition. It is time to create policy solutions that are centering the most impacted. It is time to listen

to students and allow parking permits to be shared.

Our Voices |

By Celeste Rojas

Scholarship displacement impacts students who depend on financial aid like me. Scholarship displacement is the term used to describe the situation when a student reports an external scholarship awarded to them to their university, and their original financial aid award gets reduced because of the additional scholarship, usually by the same amount of the scholarship.For this reason, I always had to think critically about applying to private scholarships or external aid for college. The best scholarship opportunities for me were those that either gave me the money directly or would provide me with a stipend. Scholarships that would be sent directly to the financial aid office were unfavorable because I knew that UC Berkeley would automatically reduce my gift aid since I was receiving extra money. There were instances where they would increase my loan offers to fill in for any gaps in my financial aid package.

In 2019, I was in an accident that caused me to get 15 stitches across the left side of my face. I reported it to UC Berkeley since I was unable to attend class and participate. To help me out they gave me $500 dollars for a hotel so my mom can take care of me. However, I didn’t know they were going to reduce my financial aid package because of those $500 dollars.

Another experience I had with award displacement was when the Cal Alumni Association, part of UC Berkeley, gave me aid through an emergency fund. During the pandemic, the Cal Alumni Association was generous enough to launch an emergency fund for students experiencing pandemic-related concerns like housing, food insecurity, or medical bills. I applied to the fund and later received about 10 Visa gift cards in the mail that amounted to my award. I was shocked they gave me Visa gift cards and asked why I couldn’t receive it all in one check to make it easier for me to retrieve the funds through my bank. They notified me that UC Berkeley would consider the check as financial aid, which would then decrease my financial aid package.

Award displacement affects all students, especially low-income students who aspire to apply to as many scholarships as possible to help with all the costs related to going to college. It’s unfortunate that institutions like UC Berkeley reduce aid amounts because scholarships can give more money to students.