California Community College Students Deserve More Support: How You Can Help!

By Changemakers Student Advocacy Fellow Veronica Liu

College: University of California, San Diego

For California Community College students, community college is a time to explore passions and potentially save money compared to immediately attending a 4-year university. For those hoping to transfer into 4-year colleges, the challenges of paying application fees, writing essays, and applying without support can be daunting as they navigate the application process. But, for the nearly 69,000 California community college students enrolled in Extended Opportunity Programs and Services (EOPS), matriculating at a community college and applying to 4-years is not a challenge they must face alone.

Extended Opportunity Programs and Services (EOPS) is a state-funded opportunity program at California Community Colleges aimed at supporting low-income and educationally-disadvantaged students to enroll in and graduate from community colleges and transfer into 4-year institutions. Established in 1969, the California Education Code states that EOPS “encourage[s] local community colleges to establish and implement programs directed to identifying those students affected by language, social, and economic handicaps, to increase the number of eligible EOPS students served, and to assist those students to achieve their educational objectives and goals, including, but not necessarily limited to, obtaining job skills, occupational certificates, or associate degrees, and transferring to four-year institutions.” EOPS was designed with disadvantaged students’ successes in mind.

My fellow Changemakers student advocate, Jessica Hernandez-Beltran, expands on her experience as a community college student in EOPS. She credits EOPS for her successful transfer path, thanks to the program’s financial assistance for textbooks and support with transfer applications.

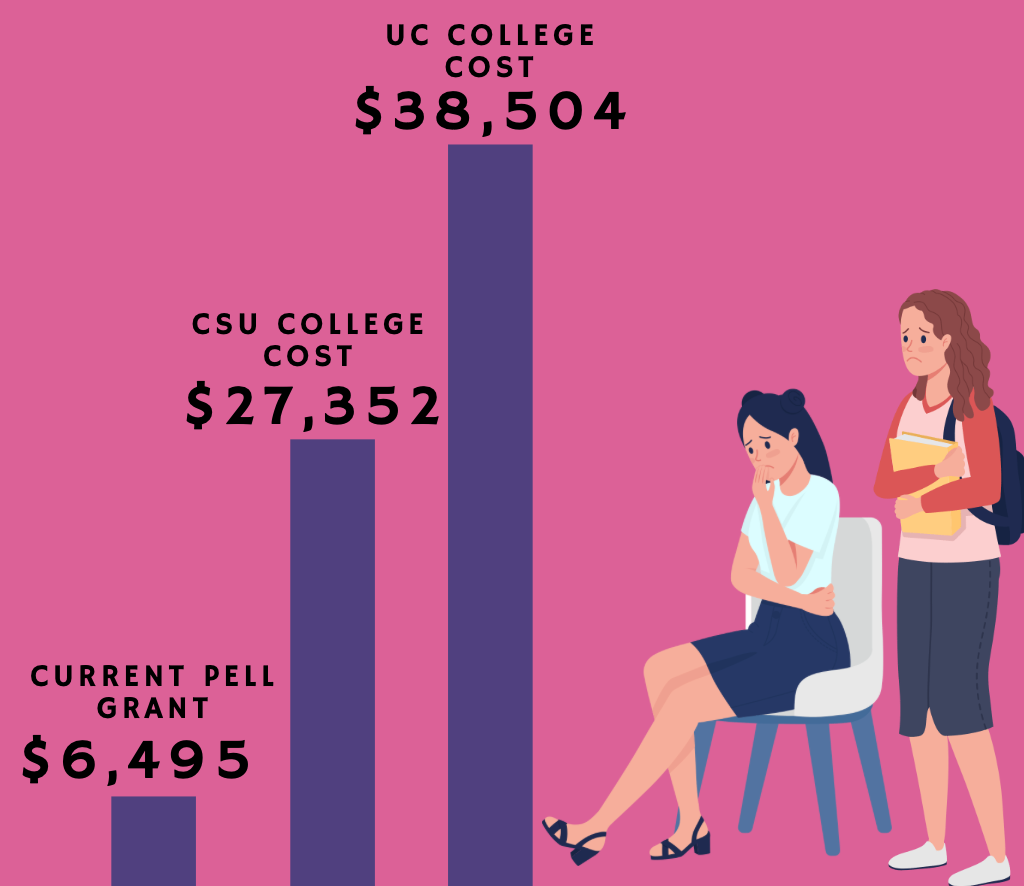

Through providing resources like textbook reimbursements/free textbooks, advising, and more, EOPS has provided students with the support and guidance needed to excel in community college, empowering students to transfer. Although EOPS students are more likely to complete transfer-level Math and English, earn higher GPAs, stay in school, and earn college credentials, EOPS only supports around 3.71% of the total community college student population–a discrepancy that does not mirror the demographics and eligibility of community college students state-wide. Think about it: how many people do you know qualify for EOPS? Who identifies as low-income, underrepresented, California resident, with Pell Grant eligibility? California is the top state in the U.S. for the most Pell Grant recipients–938,931 college students in CA qualify for the Pell Grant, including around 420,000 students across the 116 CCC campuses, a drastic contrast to the nearly 69,000 students enrolled in EOPS in Community College. Think how many folks you may know that qualify–only around 3-4% of them may be in EOPS, while others are shut out due to insufficient funding.

Funding has always been key in allowing more students to enroll in EOPS and set themselves up for success in college. In 2015, Assembly Bill 490, which increased funding for EOPS, stated that “inadequate state funding in recent years has caused many EOPS and CARE programs to reduce the amount of financial aid, textbook support, and child care grants provided to eligible students in need, to prematurely close the application deadline for acceptance to the program, to deny program services to eligible EOPS and CARE students, or to do a combination of these.” Seven years later, it seems that much still has to be improved upon, especially in regard to funding.

If you would like to show your support, please sign our letter (Deadline to sign on: November 30, 2022) and learn more about our advocacy through the link below:

Sign on here!: https://tinyurl.com/EOPSFunding22